Claim Financial Form and Calculation Rules

Risk administration is part of managing workers' comp claims. In addition to the standard workers' comp fields, you can track legal expenses. Claim financial forms are often created from imported data.

To access the claim financial form:

- On the modules bar, select WC Claims.

The WC Claims dashboard opens. - Open a claim.

The Comp Claim form opens. - In the Action Center, expand Links and select Claim Financials.

The Comp Claim Financial form opens.

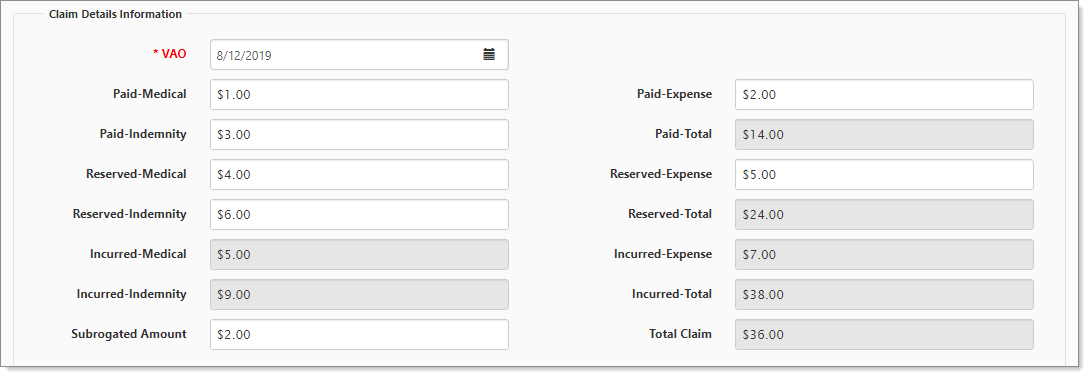

- The following legal fields are part of the Claim Financials form:

|

VAO |

Value As Of (VAO) date. For duplicate VAO dates (multiple records related to the same claim), the stored procedure peo_claimfinancialdetails_s_bykey updates the appropriate financial record by date created (create date descending, to present the most recent create date first). |

|

Paid Total |

PaidIndemnity+PaidMedical+PaidExpense+PaidLegal |

|

Reserved Total |

ReservedIndemnity+ReservedMedical+ReservedExpense+ReservedLegal |

|

Incurred Indemnity |

PaidIndemnity+ReservedIndemnity |

|

Incurred Medical |

PaidMedical+ReservedMedical |

|

Incurred Expense |

PaidExpense+ReservedExpense |

|

Incurred Legal |

PaidLegal+ReservedLegal |

|

Incurred Total |

IncurredIndemnity+IncurredMedical+IncurredExpense+IncurredLegal |

|

Total This Claim |

IncurredTotal-SubrogatedAmount |

Deductible Billing Calculation Rules

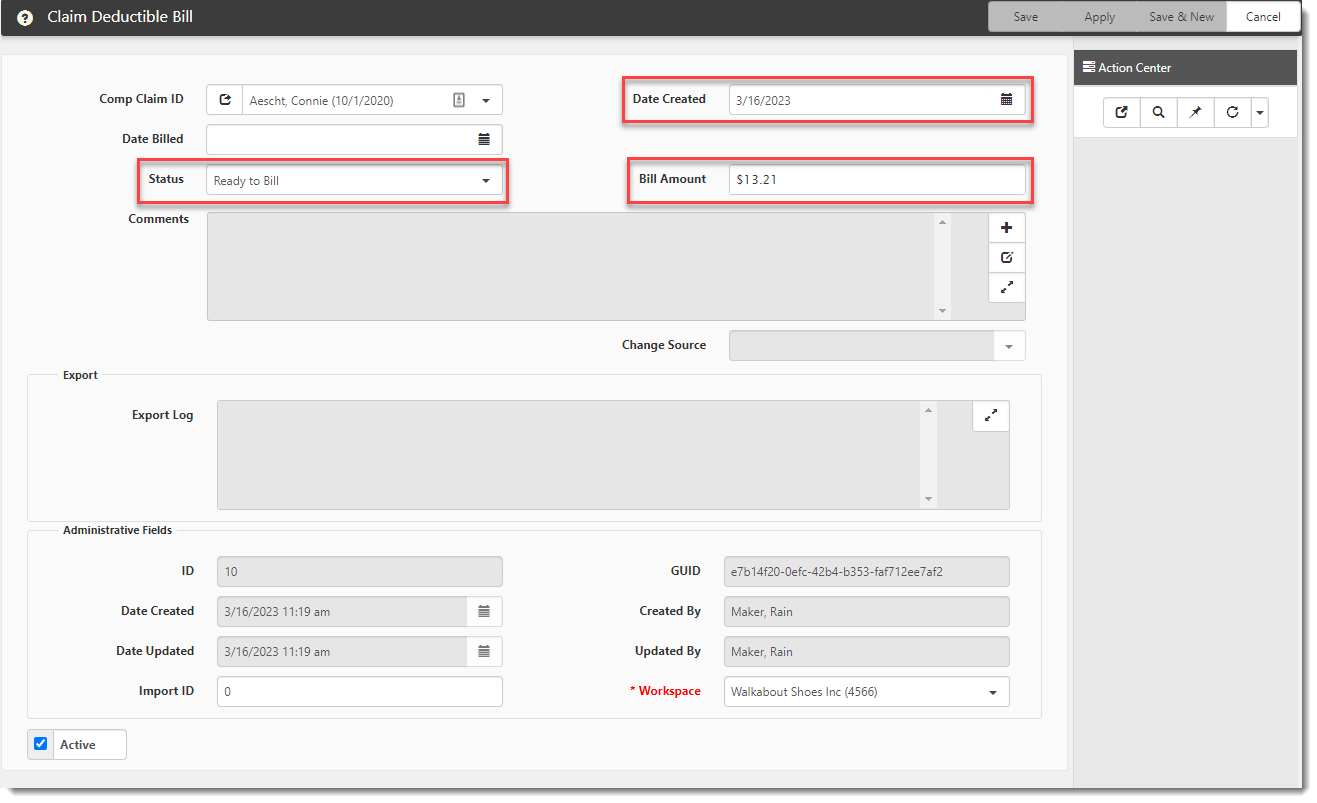

The Claim Deductible Billing business rule uses the ClaimDeductibleBilling business rule method to calculate the Claim Deductible Bill Amount. A single parameter defined in the rule details, UseTotalIncurred, informs the system whether to use the Paid-Total or Incurred-Total amount from the Comp Claim Financial record as the Claim Value.

Claim Value is defined as the Paid-Total or Incurred-Total amount from the Comp Claim Financial record. If Yes is entered in the UseTotalIncurred field on the Claim Deductible Billing Rule Details page, Incurred-Total is used as the Claim Value. Otherwise, Paid-Total is used as the Claim Value.

No trigger values need to be set for the rule to run. Rule triggering occurs when a Comp Claim Financial record is created. Special logic will determine if a Claim Billing record needs to be created.

Bill Amount Formula

-

Upon trigger of the Claim Deductible Billing business rule, the system determines a Deductible Basis by evaluating which is smaller: the specified Claim Value OR the Claim Deductible from the Comp Claim record. The Deductible Basis amount is used as value A in the bill amount calculation formula.

-

Next, the system sums existing Worker's Compensation deductible records that meet the following criteria:

-

Records are Active.

-

Records are in a status of Billed or Ready to Bill.

-

Record Source is "System"

The sum of eligible deductible records is used as value B in the bill amount calculation formula.

-

-

The system now subtracts B from A to determine the Bill Amount:

Deductible Basis (A) - Sum of Eligible Deductible Records (B) = Bill Amount

-

If the amount is zero, no Claim Deductible Bill record is created.

-

If the amount is not zero, a new Claim Deductible Bill record is created in a Status of Ready to Bill with the Bill Amount field populated and a Date Created of the current date.

-