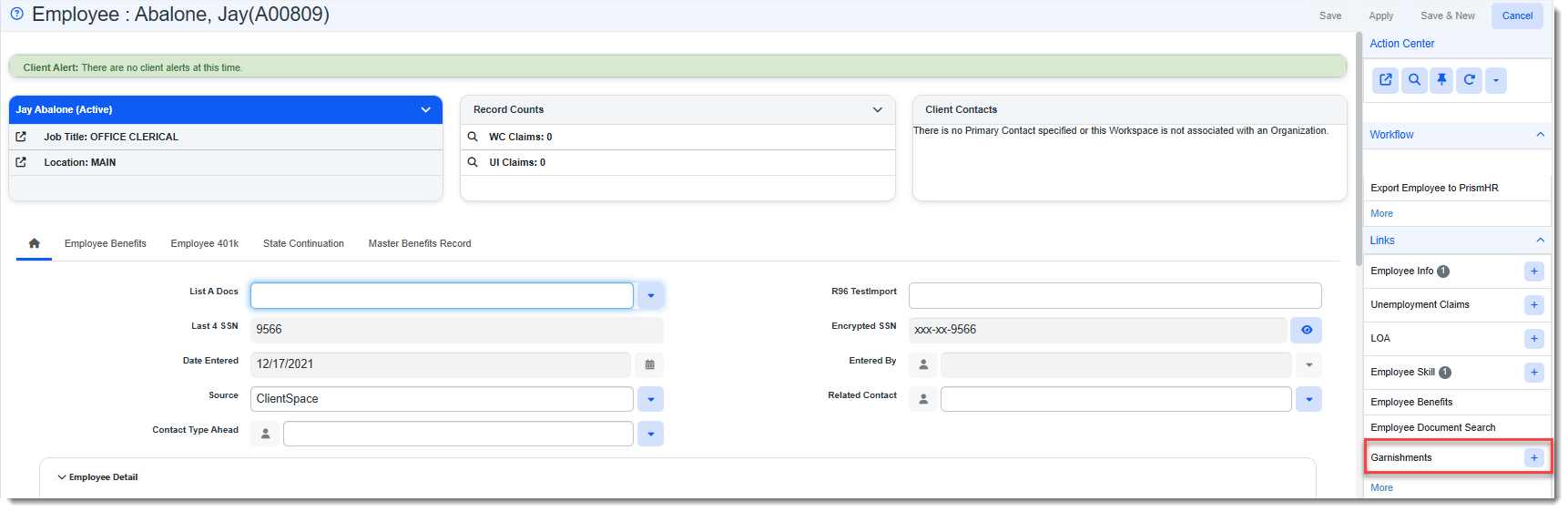

Viewing Employee Garnishments

The Garnishments dataform allows you to view employee garnishment details imported from PrismHR. A badge counter is shown next to the Garnishments link on the Employee record to indicate how many garnishment records are associated with the employee record.

This data can be used to trigger various workflows in ClientSpace. For example, rehire and new hire workflows could notify payroll to check garnishment status on an employee.

To view an Employee Garnishment record:

-

Access the Employees module and employee record.

-

Click the Employees module shortcut on the Module bar.

-

Open the desired employee record.

-

-

In the Action Center, under Links, click Garnishments.

-

What do you want to do?

-

If there are multiple existing Garnishment records for the selected employee: The Garnishments dashboard displays, filtered to show garnishment records for the selected employee. From here, you can click

(Open) next to an existing record to view the record details.

(Open) next to an existing record to view the record details. -

If there is only one record for the selected employee: The record displays when you click the Action Center Garnishments link.

-

-

Review the following fields.

Note: Imported fields cannot be edited.

Docket Number Court docket number unique to this garnishment record. Category Valid values are C (Child Support), SP (Spousal Support), I (IRS Tax Levy), B (Bankruptcy Order), S (State Tax Levy), FTB (Franchise Tax Board), O (Credit Wage Garnishment), and SL (Student Loan). Payee PrismHR Payee Code. This is the ID of the garnishment recipient. Deduction Code PrismHR Deduction Code used in Payroll classify the employee's garnishment withholding. Withholding Amount Amount withheld for the garnishment from each paycheck for the employee. Start Date

Date that the garnishment starts being withheld from the employee's pay.

End Date

Date that the garnishment stops being withheld from the employee's pay.

Override Start Date

The temporary override date that the garnishment starts being withheld from the employee's pay.

Override End Date

The temporary override date that the garnishment stops being withheld from the employee's pay.

Annotation 1

Text field containing memo, line 1 details (if entered) from the PrismHR system about the garnishment.

Annotation 2

Text field containing memo, line 2 details (if entered) from the PrismHR system about the garnishment.

Calculation Rules

Flat Amount

Flat dollar amount (with two decimal places) to withhold from employee pay, for this garnishment. This applies to all garnishment types except IRS Tax Levy, Student Loan garnishments and Child support.

Exempt Amount

IRS Tax Levy only. Amount of wages exempt from the tax levy. The amount levied will be equal to employee disposable income minus the exempt amount.

Percent of Wages

Percent of wages to garnish, instead of deducting a flat amount.

Percent Based On

Valid entries are percent of G (gross wages), N (net wages), or S (starting net wages, which are gross wages minus taxes and not including any other garnishment deductions).

Monthly Limit

IRS Tax Levy and Bankruptcy Order garnishments only. Maximum monthly garnishment amount in dollars (two decimal places)

Pay Period Limit

Bankruptcy Order, Creditor Wage Garnishment, and Student Loan garnishments only. Used in conjunction with the percentage amount to establish a maximum garnishment limit per pay period.

Percent of Disposable Wages

Franchise Tax Board garnishments only. Percent of employee's post-deduction earnings to garnish, instead of a flat rate.

Total Garnishment

Total garnishment amount.

Garnishment Fee

Fee deducted from employee's pay whenever this garnishment is processed.

State Levy Exempt Amount

State Tax Levy only. Amount of wages exempt from the tax levy.