Setting Employer Contributions

You can manually enter Employer Contributions as a dollar amount and let ClientSpace calculate the percentage OR manually set Employer Contributions as a percentage and let ClientSpace calculate the dollar amount.

Note: Business logic is in place to update these calculations automatically if plan rates change.

To set Employer Contribution amounts:

- From the modules bar, click

Workspaces.

Workspaces.

The Workspace Search dashboard opens. - Select the desired workspace and click

(Open).

(Open).

The Workspace page opens. -

Move down the page to the administrative tiles where you see the dataform categories.

-

Enter "Offered Benefits" in the search for dataform field and then click the Offered Benefits Plan tile.

The Offered Benefits Plan window displays.

Alternatively, you can access offered benefits by searching for"Benefits Batch", clicking the Benefits Batch tile and then selecting the Offered Benefit Plans link in the Action Center.

-

Click

(Open) next to the Offered Benefits Plan you want to edit.

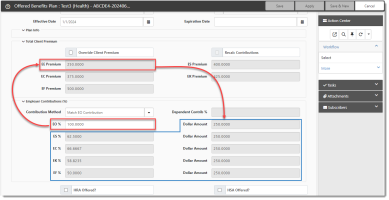

(Open) next to the Offered Benefits Plan you want to edit. The Offered Benefits Plan details for the selected plan are displayed.

-

In the Employer Contributions section in the Contribution Method field, select one of the following options:

-

Manually Set Dollars - When Manually Set Dollars is selected, the percentage fields in the Employer Contributions section are disabled. Enter the dollar amounts only and ClientSpace calculates the percentages.

Note: If you import offered benefits, and you have set the Contribution Method field of the Offered Benefits Plan record in ClientSpace set to Manually Set Dollars, your import file must contain the dollar amounts as ClientSpace calculates the Employer Contribution percentages for all coverage levels.

-

Manually Set Percentages - When Manually Set Percentages is selected, the dollar amount fields in the Employer Contributions section are disabled. Enter the percentages only and ClientSpace calculates the Employer Contribution dollar amounts for all coverage levels.

-

Contribute EO Premium - When Contribute EO Premium is selected, the value in the EE Premium field is used as the Dollar Amount for all coverage levels. ClientSpace also calculates the Employer Contribution percentages for all coverage levels as a percentage of the EE Premium.

EX: If EE Premium (i.e., Employee Premium) is $250, then the Employer Contribution Dollar Amount is $250 for the EO (i.e., Employee Only) Dollar Amount and for every remaining coverage level (ES, EC, EF, and EK) Dollar Amount. As previously mentioned, ClientSpace calculates the Employer Contribution percentages for all coverage levels as a percentage of the EE Premium. For instance, in the case of the EC coverage level, the calculation is EE Premium ÷ EC Premium.

-

Match EO Contribution - When Match EO Contribution is selected, the percentage you enter in the EO% field is used by ClientSpace to calculate the Employer Contribution dollar amounts and percentages all coverage levels.

EX: If the EO% contribution (i.e., Employee Only percentage of Employee Contribution) is 100% and the EE Premium (i.e., Employee Premium) is $250, then $250 will be set as the Employer Contribution dollar amount for all coverage levels and the Employer Contribution percentages for all remaining coverage levels is calculated by ClientSpace as a percentage of the EE Premium. For instance, in the case of the EC coverage level, the calculation is EE Premium ÷ EC Premium.

-

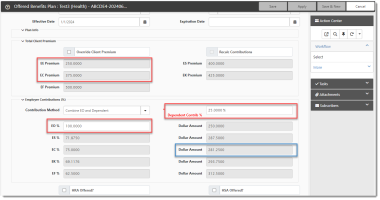

Combine EO and Dependent - When Combine EO and Dependent is selected, the Dependent Contribution is added to Employer Contribution for Employee Only (EO) to come up with the total Employer Contribution amount for an employee + dependent(s) coverage level.

First, the percentage you enter in the EO% field is used by ClientSpace to calculate the Employer Contribution Dollar Amount for EO. Then, the EO Employee Premium is deducted from the premium of an employee + dependent(s) coverage level. This difference between the EO premium and the other coverage level multiplied by the Dependent Contribution% to calculate the Employer Contribution dollar amount for a coverage level with dependents. This dollar amount is then added to the EO dollar amount to get the total Employer Contribution for the employee + dependent(s) coverage level.

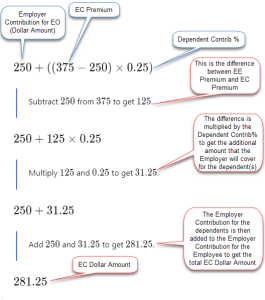

Let's look at the following example of how the EC Dollar Amount is calculated when:

-

The EE Premium is $250

-

The EO% is 100%. (This means the Employer is paying 100% of the EO premium which, in this case, results in the EODollar Amount being set to $250.)

-

The EC Premium is $375

-

The Dependent Contrib % is 25%

The formula breaks down as follows:

ClientSpace then uses the calculated Employer Contribution Dollar Amount for the employee + dependent(s) coverage level to set the corresponding Employer Contribution percentage for the employee + dependent(s) coverage level. In this case, the percentage is the EC Dollar Amount ÷ EC Premium.

-

-

-

Click Save.